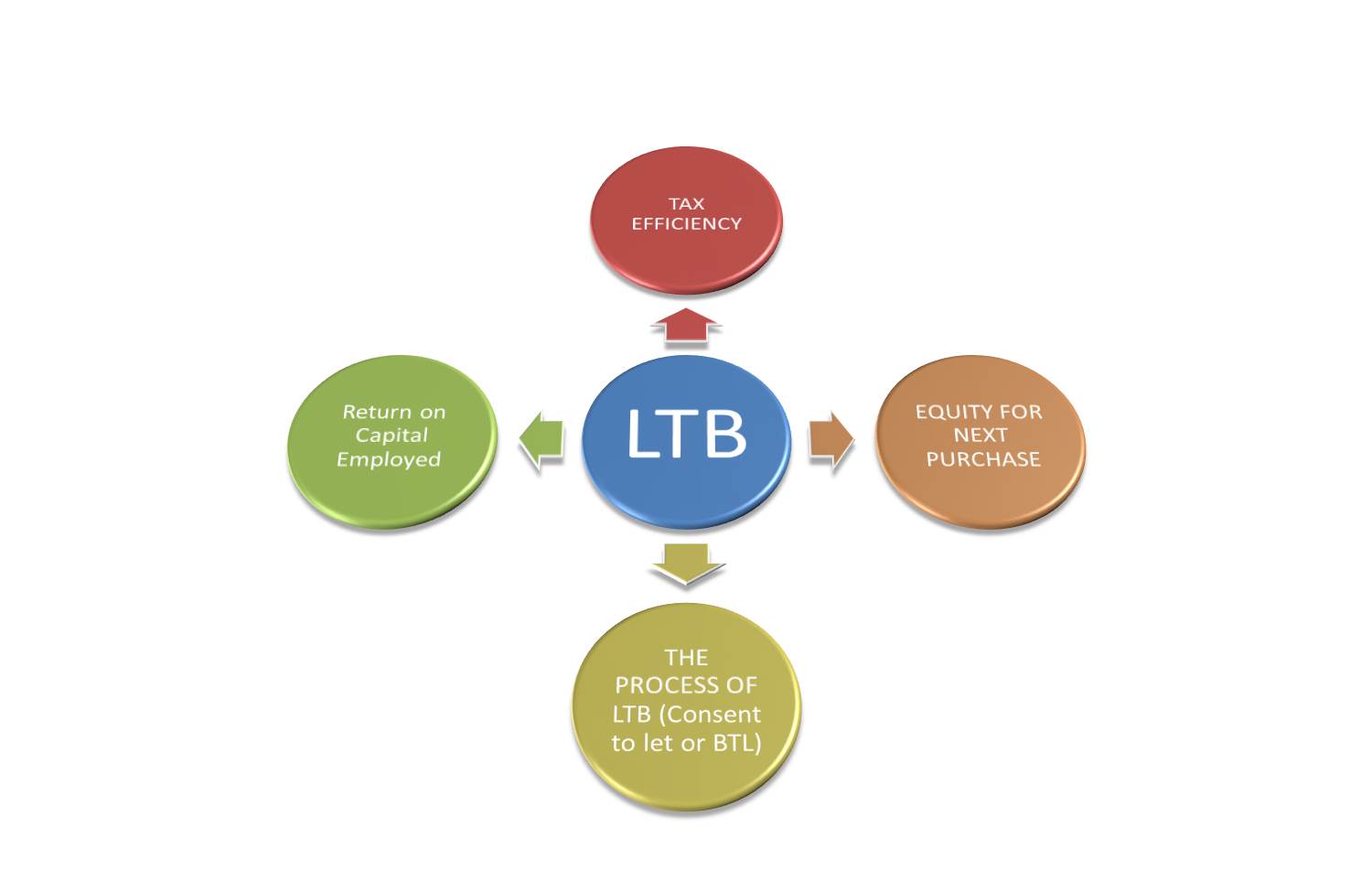

LET TO BUY

A brief overview of the considerations

By Matthew Duncan Independent Financial Adviser

What is a Let to Buy?

A let to buy mortgage is

when the new lender states they are happy for you to keep your existing

property and rent it out. Typically, the Lender will want to know the

properties rental income will

cover the mortgage payments and If this is the case the lender will ignore the existing mortgage as a

liability.

Tax Efficiency

•When

you have a BTL mortgage or equivalent the property in essence becomes and

investment.

•You

become labile for income tax on any profit you make.

•Net

profit is the difference between your rental income minus allowable expenses.

•One

of the allowable expenses is mortgage interest (Not any capital repayment

element).

•The

Net profit is added to your employed income and taxed at that rate.

•If

you reduce the mortgage interest by paying off capital elements of the BTL

mortgage you actually

reduce the allowable expense and therefore increase you

tax liability. This is not an issue if you have

no other mortgages but if you

do have a personal mortgage it is not very tax or risk efficient.

Equity for the next Purchase

If there is equity in your current property it may be worthwhile seeing if you can release some of it.

By releasing this equity you may be able to get a better rate on the new mortgage if the LTV is

reduced. Other key considerations are that by having a lower personal mortgage on the new property you are reducing your personal risk and by loading the BTL you are increasing the allowable expense for tax purposes therefore reducing your tax liability.

Return on Capital Employed

It

must be remembered that the property that is being let will become an

investment. It is therefore worthwhile looking at the maths to ensure the

property is viable as an investment.

A

property can return profit in two ways.

1.Capital

growth

2.Return

on capital

Return

on capital looks at what capital has been employed and the return on this

capital. For example if £30,000 has been used via equity or introduced

(purchase) and the rental profit per year is £3,000 then the return on capital

employed is 10%.

BTL or Consent to Let

•Depending

on each lenders criteria and mortgage interest rates you may wish to consider

changing

to an official BTL mortgage.

•The

other option is you ask your current provider for the consent to let. Typically

they will change

you a fee for doing so and leave your mortgage on the same

terms. Some lenders will increase your

interest rate to reflect you are renting

it out.

•Both

types of mortgage are acceptable for future lenders if you are looking to Let

to buy.

+Jpeg.jpg)